WA Scam Warnings

-

Car Crash Compensation Phone Scam

Read More...Scammers are offering compensation for a car accident in an attempt to obtain personal information from victims.

-

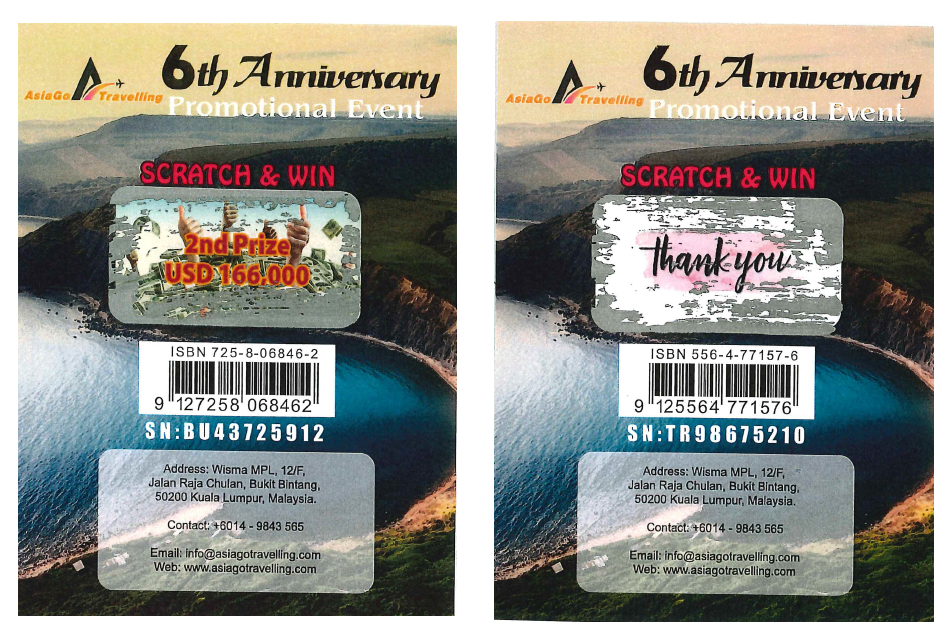

Travel Scratchie Scams

Read More...WA ScamNet is advising consumers to be on the lookout for a scratchie scam sent to their letterbox. We advise not to respond as you will not receive any prize money. Do not send any financial or personal information as it could be used in identity theft scams.

-

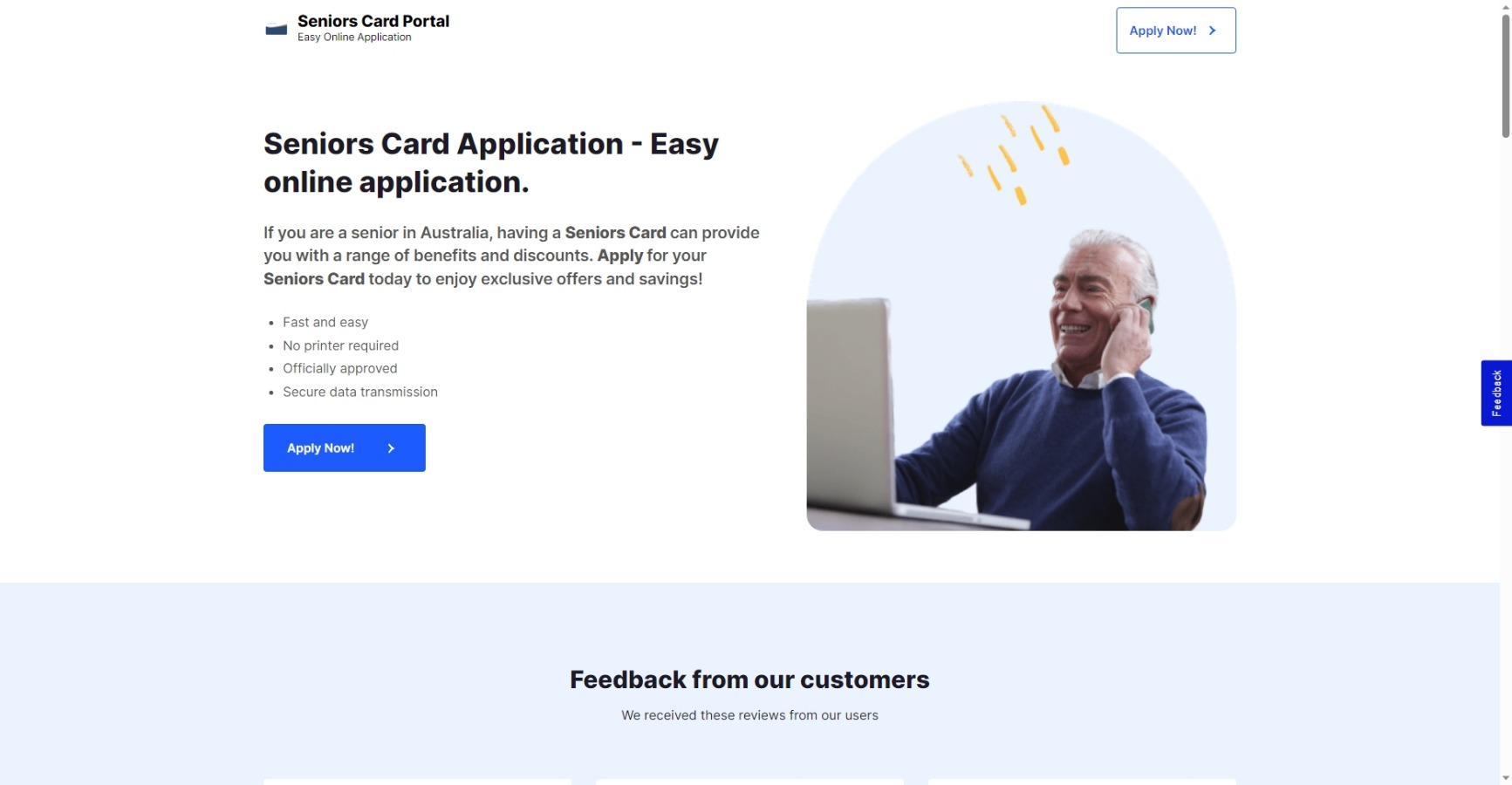

WA Seniors Card scam

Read More...Western Australian seniors are being targeted by scammers through a scam WA Seniors Card website requesting money and multiple forms of personal identification.

-

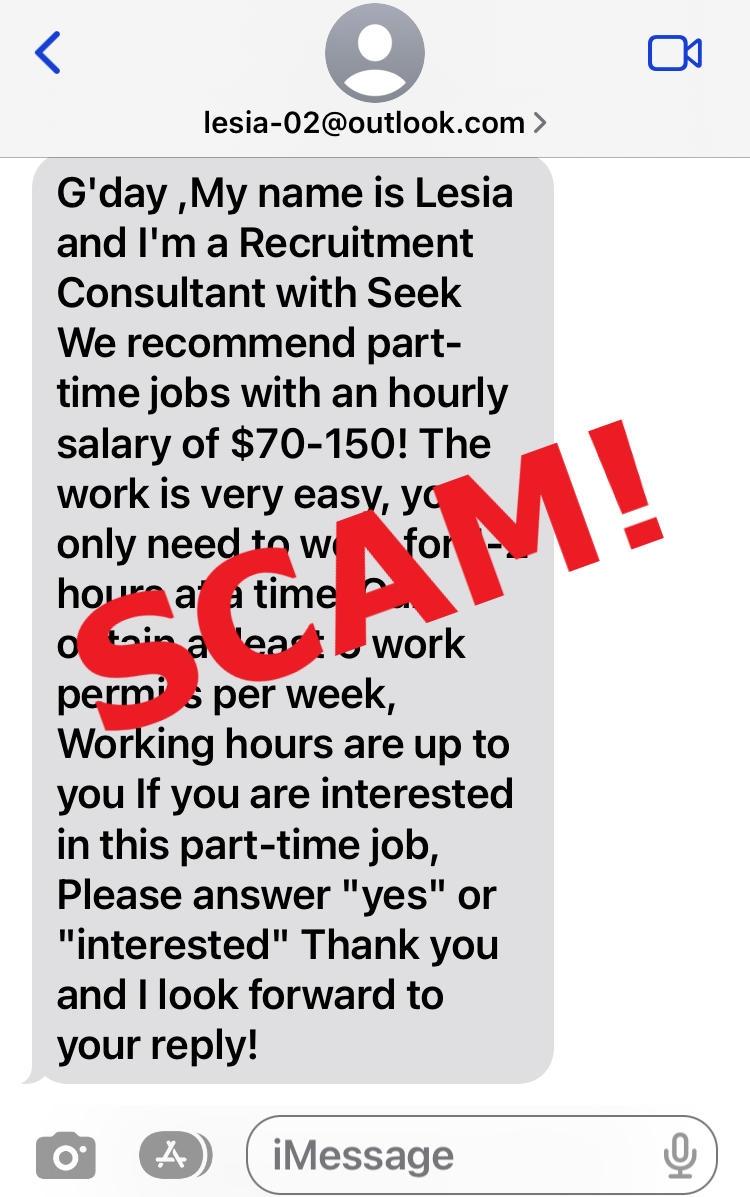

Flexible Work Scam

Read More...People seeking jobs with flexible work conditions, such as working from home need to watch-out for job scams that attempt to steal your money, rather than make you any.

Latest WA ScamNet updates

Help for spotting scams

The spotting scams fact sheet covers:

- Scams such as hot deals and finance, urgent threats and phishing scams

- Protecting your personal information, passwords, your computer / smart device

- Tips when using social media or online dating

- Tips on protecting your money

Download a copy of the Spotting scams factsheet

Download a copy of the Spotting scams factsheet

ScamNet Talks

Do you want to know how to spot a scam?

We regularly run presentations to groups about tips on how to spot a scam and what to do if you or someone you know has been targeted by a scammer.

Read more to book a session