WA Scam Warnings

-

Event and Festival scams

Read More...Watch out for fake adverts for events or festivals spreading across social media, prompting a warning for WA consumers to be on alert for scams and avoid buying tickets to events that do not exist.

-

Fake shipping container websites

Read More...WA ScamNet has received a number of reports about fake websites claiming to sell discounted shipping containers that are never delivered after payment is made.

-

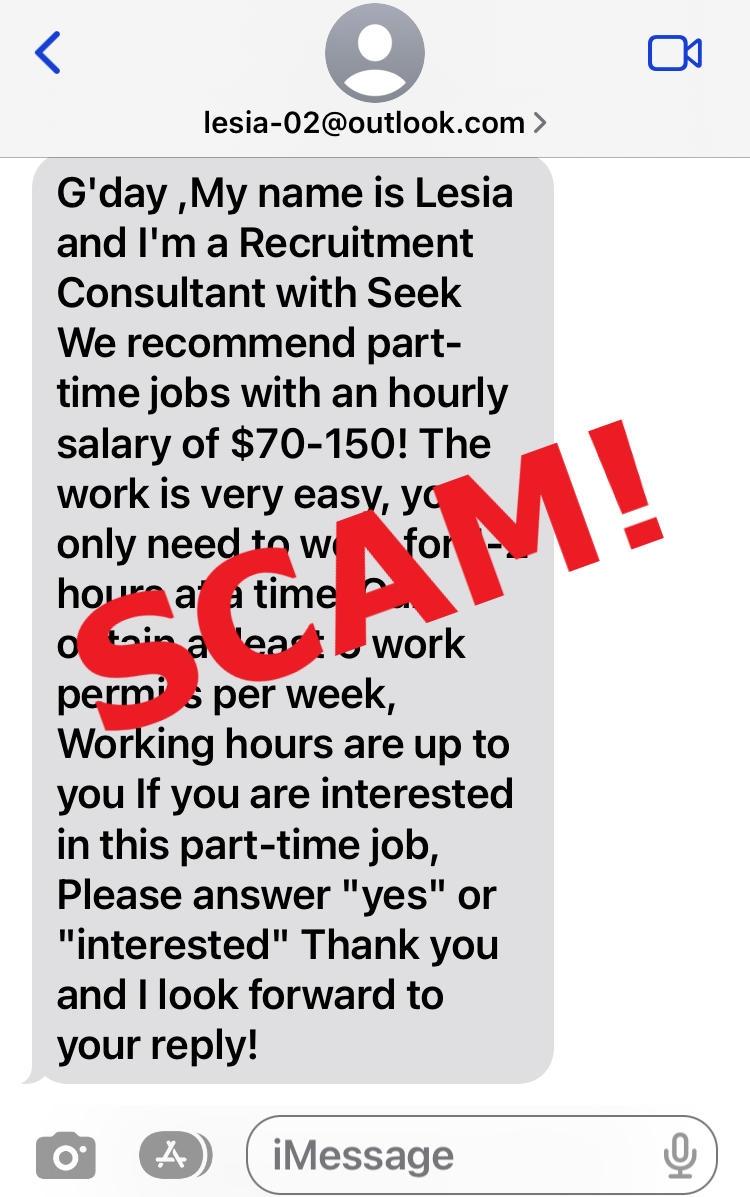

Flexible Work Scam

Read More...People seeking jobs with flexible work conditions, such as working from home need to watch-out for job scams that attempt to steal your money, rather than make you any.

-

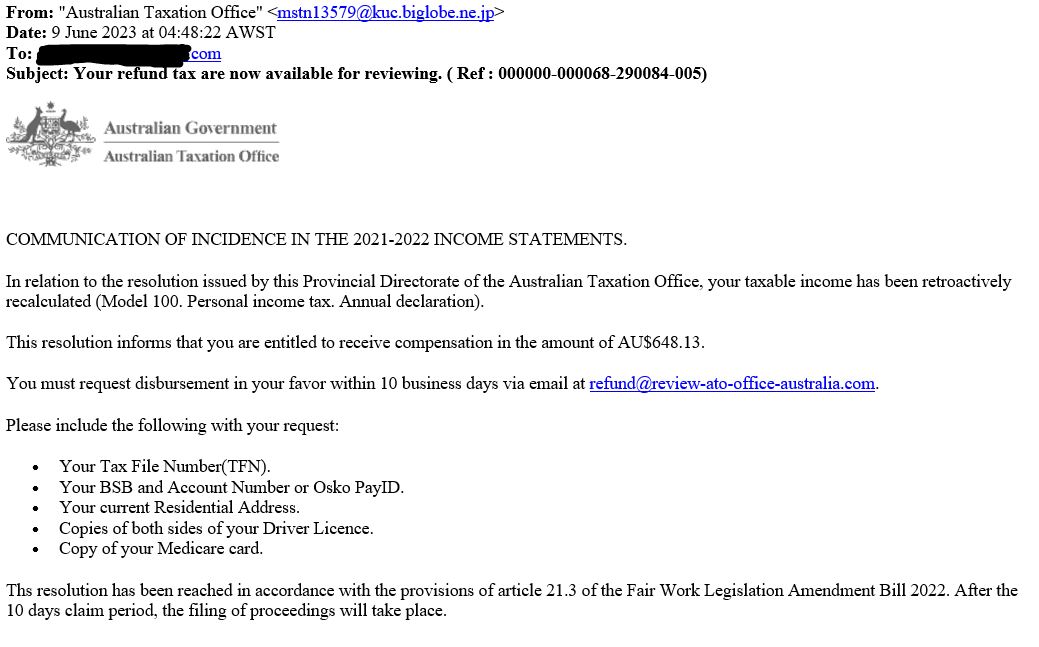

Tax phishing emails

Read More...WA ScamNet has renewed its warnings about fake tax communications after fresh reports of emails claiming to be from the ATO. Do not click on any links. Just delete it.

Latest WA ScamNet updates

Help for spotting scams

The spotting scams fact sheet covers:

- Practise the pause

- Verify with the source

- Protect your computer, devices and accounts

- When shopping online or on social media platforms

- Take action if you have been scammed

Download a copy of the Spotting scams factsheet

Download a copy of the Spotting scams factsheet

ScamNet Talks

Do you want to know how to spot a scam?

We regularly run presentations to groups about tips on how to spot a scam and what to do if you or someone you know has been targeted by a scammer.

Read more to book a session