The Bitcoin Investors Club scam

WA ScamNet received a report of a $5,000 loss to The Bitcoin Investors Club which claimed that the investment would be worth $40,000 in two years.

WA ScamNet received a report of a $5,000 loss to The Bitcoin Investors Club which claimed that the investment would be worth $40,000 in two years.

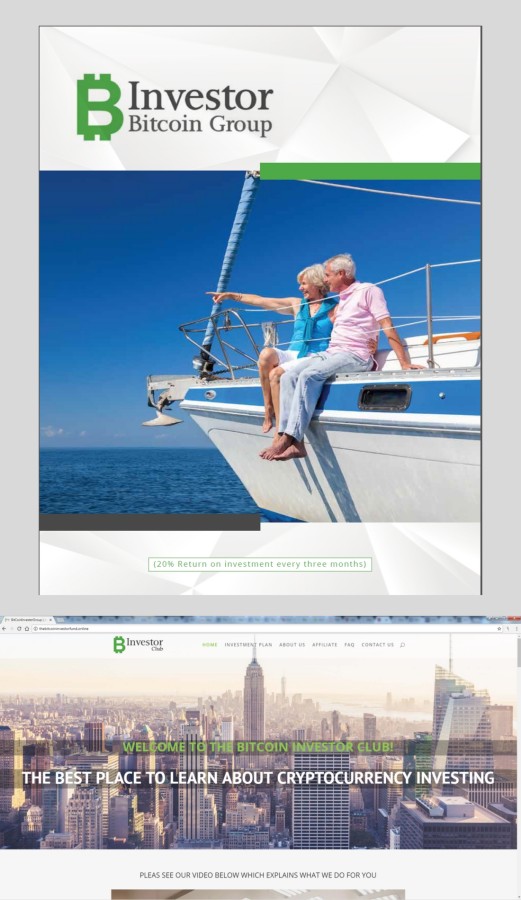

The victim was on Facebook when he came across an advertisement for the club and made contact via email. The club provided a brochure and contract information which included a company name and an Australian Company Number (ACN).

A website contained a video of someone spruiking the club’s services as well as video testimonials from people who claim to have made a large amount of money, while the brochures claimed the investment would yield 20% profit per three months. An email provided similar information as well as requesting that a deposit be paid into an ING account.

After the victim transferred $5,000 into the account, the club made contact again requesting more money in order to increase the profits but the victim refused.

Searches through ASIC and ABN lookup show the ACN 621118447 and company name The Bitcoin Investor Club Pty Ltd are not valid within Australia.

A search of the New York State corporation registry shows there is not a business registered under Investor Bitcoin Inc.

The Bitcoin Talk forum contained comments on Investor Bitcoin being a scam.

The scam website (www.thebitcoininvestorclub.com) has been suspended and is no longer active, and the phone number 1800 683 926 is also no longer active.

The bank account has been reported to ING and the website http://thebitcoininvestorfund.online has been reported as bogus.

The scam Facebook pages have also been reported -https://www.facebook.com/InvestorBitcoinInc/ and https://www.facebook.com/Thebitcoininvestorclub-330952383996800/.

Advice:

Be wary of any investment which claims to offer a high return with little risk and get independent financial advice before committing any money.

Only use operators with an Australian Financial Services licence or who are authorised by an AFS licensee. Also check on the ASIC website for more information on investing with information about bitcoin and virtual currencies also available on the MoneySmart website.

Related Scams

-

Get rich quick Bitcoin scams

Read More...Scammers are using images of Federal Treasurer Josh Frydenburg to lure consumers into a cryptocurrency con that falsely claims to have made millions of dollars for thousands of Australians.

-

The Bitcoin Code and Bitcoin System

Read More...WA ScamNet is warning consumers about a binary option trading scam called the Bitcoin System.

-

Visdom Investment Management, Chicago

Read More...Scammers have set up a fake investment company to defraud investors using the name of an investment company based in Hong Kong.

-

Absolute Finance Pty Ltd

Read More...We recently received a report about the loss of €300 Euro from the victim of a fake binary options trading scam - Absolute Finance Pty Ltd.

-

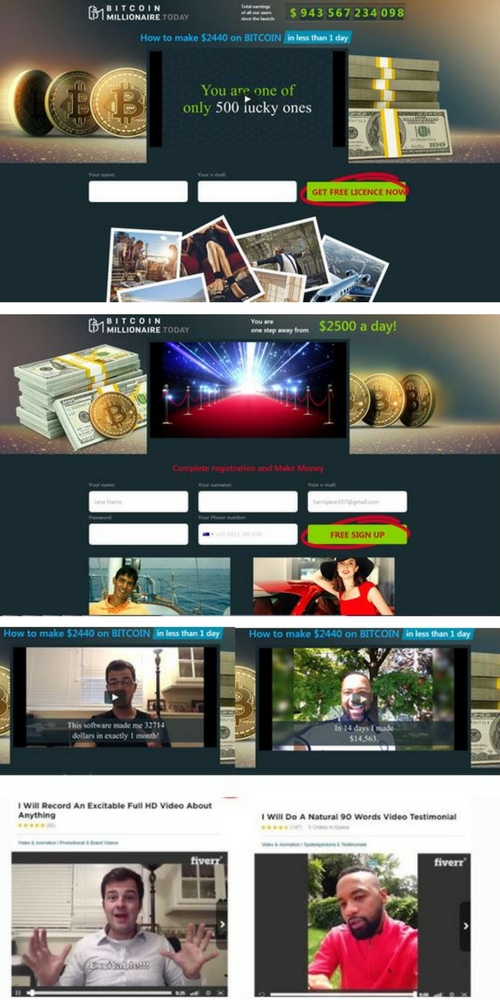

Bitcoin Millionaire Scam

Read More...Western Australian’s are being targeted with spam emails and links to a website offering a bitcoin trading software which promises to makes $2440 per day. The email and website say they will realease as few as 500 licences for the software, creating a sense of urgency.

-

The Aussie Method

Read More...WA investors are suffering large losses after being scammed by bogus companies and websites offering investment opportunities in binary options’ trading. Nationally, according to the ACCC, Australians have lost a total of $3 million in 2016.

-

ANZ refunds phone scam

Read More...ANZ is to refund $5 million to about 25,000 basic account holders for incorrect charges.

WA ScamNet has had a report of a phone scam where the caller claims to be from the Australian Government offering an ANZ refund.

-

Online Loan Scam - Finance Money Australia

Read More...Consumers looking for loans online are again being stung by paying fees or insurance charges upfront to scammers who have stolen the identity of legitimate credit providers.

-

Larosa Group

Read More...Massive losses are feared after Austraians were duped by a bogus investment company operating a fake website.

-

Public warning about Gerardus (Gerry) Jorissen

Read More...WA ScamNet and Consumer Protection are warning Western Australians not to deal with Gerardus (Gerry) Hermanus Jorissen who has sent at least $200,000 of other people’s money to overseas criminals under the guise of an investment scheme.

-

Online loan scammers posing as Mercury Money

Read More...In the last few weeks consumers have contacted WA ScamNet at Consumer Protection after being defrauded by scammers posing as Mercury Money – a legitimate brokerage company based in Perth.

-

Sea container investment schemes

Read More...Caution urged over sea container investment schemes and promotions (also known as ‘acquisition of maritime containers’).

-

West Perth man arrested for a series of real estate fraud offences

Read More...Perth City Detectives have arrested a West Perth man for a series of offences, whereby he allegedly recieved security bonds and advance rent for properties he had no authority to rent, targeting mostly international victims. Anyone who has concerns or knowledge regarding this man is asked to call Crime Stoppers on 1800 333 000.

-

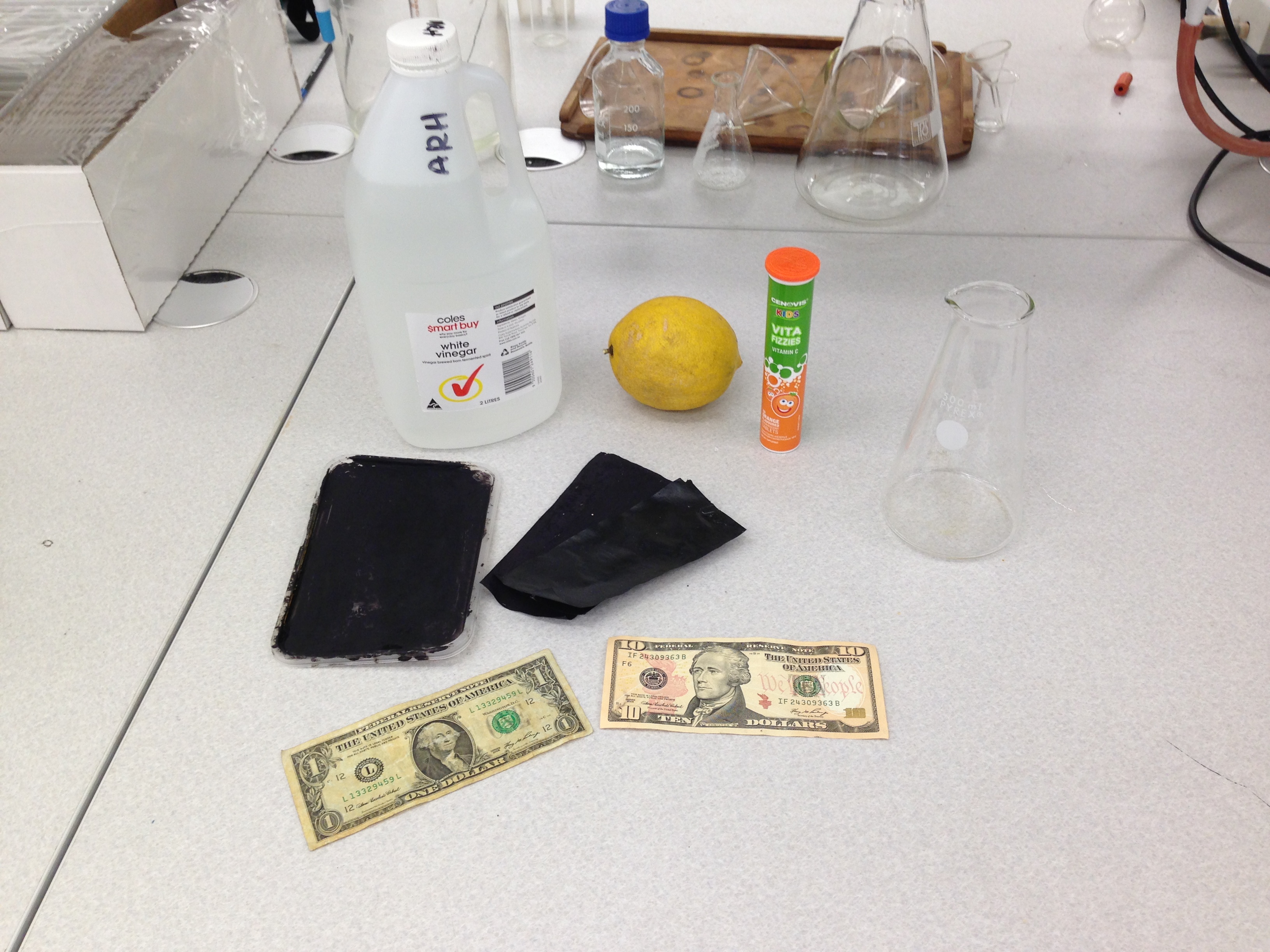

Money wash

Read More...A 56 year old man from WA’s South West has suffered a two million dollar loss, the largest ever reported to Project Sunbird, after becoming a victim of an investment and ‘money wash’ fraud.

-

Sports Arbitrage

Read More...The last time Consumer Protection warned Western Australians about sports arbitrage and prediction software was in 2010 and it’s still a sure bet if you want to lose money.

-

Investment seminars & real estate scams

Read More...Some investment seminars may try and convince you to follow high risk investment strategies, such as borrowing huge sums of money to buy property. Others promote investments that involve lending money on for no security—or with other risky terms. While investment advice can be legitimate and beneficial, it is important to look carefully at what an investment scheme or seminar is offering. Attending an expensive seminar or investing in the wrong kind of scheme can be costly mistakes.

-

Credit card scams

Read More...A credit card scam can come in many forms. For example, scammers may use spyware or some other scam to obtain your credit card details. A scammer might steal or trick you into telling them your security code (the three or four digit code on your card) and then make purchases over the internet or the telephone. If they know your PIN, they could get cash advances from an ATM using a ‘cloned’ credit card (where your details have been copied onto the magnetic strip of another card).

-

Misuse of Ukash by scammers

Read More...WA ScamNet has been warning consumers about the dangers of wire transfer since the scam warning website was originally launched back in 2002. Up until now the predominant service misused during scams targeting Australians has been Western Union. However several recent reports (July 2011-March 2012) received by Consumer Protection and investigated by WA ScamNet have involved a service called Ukash.

-

Customs Fees

Read More...The Internet is an increasingly popular way to buy and sell goods. Many scammers are becoming more sophisticated, targeting these transactions with bogus claims for Customs fees.

-

Investment proposal email

Read More...An overseas company is looking for partners to assist them in investing millions of dollars in Australia. You could stand to profit by as much as 35% of the initial investment. Sounds too good to be true – it certainly is!

-

Law Enforcement Agency Scams

Read More...Scammers are doing their homework on Government law enforcement agencies and copying logos and job titles in order to dupe people into sending them money.

-

Sports Arbitrage/Prediction Software Schemes

Read More...If you take a gamble with sports arbitrage or share prediction schemes you can bet your bottom dollar you’re going to lose money.